Remote work has shifted the way we live and work, offering flexibility, but it also presents unique challenges for maintaining productivity and managing personal finances. Balancing your budget effectively while working from home doesn’t have to be a daunting task. This blog highlights actionable, practical strategies on how to stay financially smart and professionally efficient in the comfort of your home.

Why Productivity and Finances Go Hand-in-Hand

Your productivity directly impacts your earning potential, particularly if you’re working remotely or freelancing. Likewise, managing your budget wisely can help ensure that the flexibility of working from home does not lead to unnecessary expenses that dig into your savings. By streamlining both aspects, you can stay on top of your financial wellness while ensuring your work productivity remains optimal.

1. Set a Budget for Working from Home

Though remote work helps cut costs like commuting and eating out, it can come with other expenses, like higher utility bills or the need for proper office equipment. A well-planned budget can prevent overspending and ensure you’re benefiting financially from remote work.

- Track Your Expenses: Use budget tracking apps to monitor spending categories like groceries, utilities, and subscription services.

- Save on Workspace Essentials: Look for deals on office furniture and supplies, and consider second-hand options to save money.

- Optimize Your Home Office: If you’re a homeowner, consider specific investments that may qualify for tax benefits or home equity improvements that add long-term value. For example, a home equity loan in Utah can provide funding to create a functional yet budget-friendly office.

2. Explore Passive Income Options

Generating secondary income streams is a smart way to boost your finances while continuing your primary job. Working from home presents an opportunity to explore passive income possibilities that align with your skills and interests.

- Online Investments: Apps and platforms can help automate stock or crypto investments. Just ensure you thoroughly research and understand markets before you invest.

- Rent Your Space: If you have an extra room or space, consider platforms like Airbnb to generate rental income.

- Sell Unused Items: Websites like eBay or Facebook Marketplace can turn your clutter into quick cash, keeping your home workspace minimal and functional.

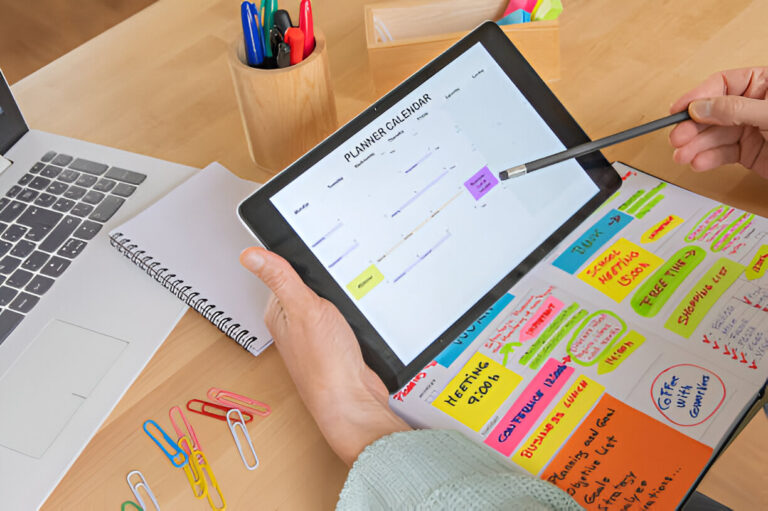

3. Use Technology to Uphold Productivity and Save Costs

The wealth of online tools and software available makes working from home not only productive but also cost-efficient. With careful selection, these tools can save you both time and money.

- Time-Tracking Tools: Apps like Toggl or Clockify can help you monitor your working hours, ensuring you’re hitting productivity goals.

- Collaboration Platforms: Free or affordable tools like Slack and Zoom eliminate unnecessary costs associated with premium software, allowing smooth communication and collaboration.

- Energy Savings Gadgets: Smart plugs or energy-efficient monitors can help reduce electricity bills while providing tech-savvy convenience.

SEO Keywords for Backlinking

- Boosting remote work productivity.

- Managing home office budgets effectively.

- Practical passive income strategies for remote workers.

- Best financial tools for work-from-home professionals.

4. Revisit and Reassess Financial Goals

One of the key benefits of working from home is having the flexibility to revisit financial goals more regularly. Without the need for lengthy commutes or constant distraction, you have a unique opportunity to reflect on goals like saving for retirement or paying off debts.

- Set Short-Term Milestones: Allocate a portion of your monthly earnings toward goals like building an emergency fund or savings for upcoming vacations. This keeps you financially prepared while giving motivation for the future.

- Consolidate Debts: Look into consolidating high-interest debts into lower-interest options like personal or home equity loans to simplify payments.

- Educate Yourself: Free webinars and podcasts on finance management can provide you with insights to optimize your portfolio or improve monetary decisions.

5. Connect with Like-Minded Remote Professionals

Networking is just as crucial in remote work as it is in traditional office settings. Bonding with a community of like-minded individuals can offer new growth opportunities.

- Virtual Networking Events: Platforms such as LinkedIn often host virtual meetups and workshops tailored to specific professions.

- Financial Communities: Join online forums where professionals discuss remote work-related expenses and share budgeting hacks.

- Productivity Groups: Collaboration within these groups can provide you with task management ideas and accountability partners.

Effective Financial Strategies Begin at Home

Working from home is an advantageous arrangement, but it requires discipline and thoughtful planning. Maximize the advantages of saving on commuting or dine-out costs by investing in tools and skills that ensure steady financial growth while improving your daily workflow. By aligning productivity goals with smart budgeting and income strategies, you can truly make the most of your remote work lifestyle.

david Miller is an experienced English language expert with a deep passion for helping others communicate effectively and confidently. With a background in linguistics and literature, He provides clear, accessible insights on grammar, writing, and communication strategies. Through well-researched articles and practical advice, David Miller aims to make language learning both inspiring and achievable for readers of all levels.